Content

Dealing Desk brokers are those who make money from spreads and the service of providing traders with liquidity. You can view pricing available on either side of the order book and have the ability to place orders within the top of book spreads. No, MetaTrader 5 is not a broker but a third-party trading platform that allows you to connect to your broker if your broker supports the platform. While you can execute your trades on MetaTrader 5, the transactions are facilitated by your broker and not the platform. FBS offers low minimum deposit requirements on most of its accounts from $1.

Some are regulated by official regulation bodies while others can do pretty much whatever they want. The STP forex broker will direct clients’ transactions straight to liquidity providers and interbank markets. This type of forex brokers usually has multiple liquidity providers, each of whom would offer different bid/ask prices . Choosing a reliable forex broker is the first step you will have to take. Whether you are a beginner trader or an experienced investor, choosing the top forex broker is essential for success in this dynamic and rapidly-growing market.

- However, dealing with Indonesian traders who register with foreign brokers may be more complex than those who register with local brokers.

- They would then add a small markup and then quote the marked-up bid and ask prices to their clients.

- There is a need of a platform where buyers and sellers can interact with each other for the sake of trading and the forex broker provides that platform.

- A fixed spread is not changing and remains on the same level no matter what happens in the market.

- ECN brokers allow their clients to interact directly with participants in the Electronic Communication Network market, including banks, hedge funds, other brokers, and other traders.

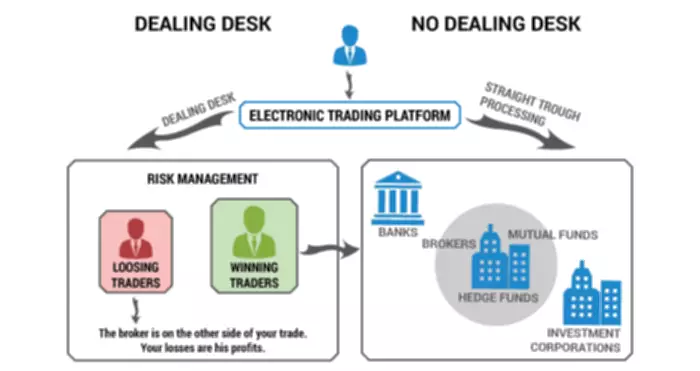

- Unlike ECN and STP brokers, a forex market maker is a broker that doesn’t cover positions on liquidity providers and is obliged to pay for client’s beneficial trades with its own money.

- Any and all partnerships with industry regulars are not and should not, be viewed as an endorsement or recommendations by topfxbrokersreview.com, even though we may be sponsored by some of the brokers.

There are forex brokers who offer a hybrid model to their clients. The hybrid model essentially is a model that combines all the features of the ECN, DMA and the STP. It allows the forex trader to take advantage of the best features available on all three. One reason forex brokers use the DMA is how fast the execution is. The forex market requires a fast transaction rate to keep up with changes. The DMA forex broker has the best features, especially in a volatile market.

How much do I need in order to trade forex?

Simply put, if you place a buy order with a B-Book broker, they will be selling to you and vice versa. Some benefits of B-Book brokers include guaranteed fills on your trades. Meaning that even if liquidity is low, you still receive good execution of orders as the broker acts as a market maker.

A straight-through processing broker directly forwards the trading orders to a number of liquidity providers in the interbank market that have different quote rates for the trading transaction. A true ECN broker connects traders directly with counterparties in the interbank market. The only role the broker plays in the transaction is creating the link between buyers and sellers… They do not set their own price rates or manage inventories in any way, as all the price rates are taken directly from the interbank market.

How to choose the right Forex Broker

The analysis covered over 400 companies, with the analysts using around 100 different criteria of assessment. As a part of the analysis, the experts objectively evaluated the popularity and quality of services of brokerage companies using a unique TU methodology. Trading leveraged products such as Forex and CFDs may not be suitable for all investors as they carry a high degree of risk to your capital. 👋 Today we are going to share a quick write-up about the “Rounding bottom” formation, along with a few examples that may help you solidify your understanding of this chart pattern. Please remember this is an educational post to help all of our members better understand concepts used in trading or investing. It’s important to be familiar with the currency pairs you’re trading in.

A good Forex broker should offer consistently good liquidity and smooth execution, which are the mainstays of smooth trading conditions. This is because trading is easiest in such conditions, and loss causing events such as slippage less likely. Liquidity can of course shorten at certain times of the day, making spreads wider at certain time. No broker can be expected to provide narrow spreads just before a major news announcement.

ECN brokers generally require $1,000 and above as initial deposit, so traders with lower trading capital may not have this option. But certain trading strategies, such as scalping, require tighter interbank spread offered by ECN brokers. It is important to note that ECN brokers usually require higher initial deposits than other types of brokers because most of the participants in the interbank market only trade in large lot sizes. One more thing, since order execution depends on finding a matching order in the market at the time it’s placed, there may be order execution delays, rejections, or re-quotes. ECN brokers connect their traders’ orders directly with counterparties in the interbank market.

Approach to Forex Trading

This type of trading involves taking advantage of price movements between different currencies and requires the use of a reliable forex broker to execute trades on behalf of traders. A forex broker offers its clients currency prices from liquidity providers like major banks. Through a forex broker, traders can open trade positions on currency pairs either by buying or selling the currency pair.

FBS has account types with spread starting from -1 point, which is incredibly convenient for all traders. These market-leading trading conditions help traders to perform better without worrying that the spread will shrink their profits. With market makers, trades are never executed at the real interbank market. Some market makers may hedge your orders at the true interbank market, but obviously that’s not always the case. A dealer, on the other hand, may take positions in various securities. E., owns the stock and the stock declines in price, the dealer loses money.

No, you cannot trade forex without an intermediary to facilitate the transaction. A broker, bank, or any other foreign exchange provider is the only link to the forex market. EToro offers Muslim traders the chance to convert their standard account into an Islamic account. There are no admin or swap fees charged on this account and Muslims can expect spread charges from 1 pip. AvaTrade offers over 1,250 financial instruments and an award-winning AvaTradeGO app. AvaTradeGO offers traders some of the best educational material and research tools to help them navigate competitive markets.

The different types of forex brokers

Moreover, when they get overwhelmed by clients’ orders in one direction, they pass them on to their liquidity providers. The fact that a broker takes the other side of a client’s trade can, in itself, make one think that there is a conflict of interest. Different forex brokers will have different risk management policies, so make sure you check the policies before deciding to open a forex account with best forex broker.

Different forex brokers have a distinct way of providing services. Despite that, they all work to provide the same essential service for all forex traders. There are two categories of forex brokers which forex traders have to know how they work. It is crucial to understand the differences between these forex brokers. This information will be helpful if you are considering choosing a forex broker to work with. ECN brokers connect traders directly with counterparties in the interbank market.

One thing to note here is that some brokers who claim to be STP/ECN may actually use a hybrid model. It could be, we can’t even close a trading position that has been opened. A number of these city brokers set limits or prohibit certain trading techniques . However, there is also a Bucket Shop that allows all kinds of trading techniques because the system actually has an automatic script installed that can hinder these techniques . This type of broker usually has a good reputation and is legally registered , as well as not located in a remote or obscure place. For another year, AximTrade has made a roaring success making its mark in the global trading scene as the fastest growing broker.

For the price to progress, there should be enough buy market orders to take out all the orders at the supply zone or enough sell market orders to take out all the orders at the demand zone. So, by seeing the size of orders at these price levels, a trader can better plan his trades and also know where to expect difficult price movements. With many jurisdictions restricting the access of foreign brokers to their residents, forex brokers can also be classified based on the countries in which they operate.

Examples of market makers Forex brokers

If you do not have all the time to analyze forex charts in as detailed a manner throughout the day, but only for a couple of hours, this trading strategy may be most ideal for you. NDD broker literally means ‘without going through the dealing desk’. This type of forex broker is really a ‘bridge’ between traders and the interbank market. Service group determines the level of competitiveness of a brokerage organization, taking into account the company’s influence on other market players. Based on the results of the analysis, the list of the Best Forex Trading Apps for 2022 was compiled and published on the Traders Union website.

Accounts should only be established with properly regulated brokers to avoid any issues with the security of funds and the honesty of the broker. FBS is an international broker with more than 150 countries of presence. 27,000,000 traders and 410,000 partners have already chosen FBS as their preferred Forex company. Find the approximate amount of currency units to buy or sell so you can control your maximum risk per position. An individual or firm employed by others to plan and organize sales or negotiate contracts for a commission.

Swing Trading

The broker you choose should act as a partner, giving you access to tools that boost your confidence when trading in volatile financial markets. Brokers with a good reputation will have several tools available to help their customers become better traders. The DMA forex brokers have transparency because traders can see the trades live and see other matching orders. They are non-dealing desk forex brokers, therefore traders can get assured that there are no third parties involved. Because orders get executed by the system, therefore it has low errors. The forex brokers also ensure that the trader is anonymous such that all their data is not shared, only the transactional details.

When a forex broker places an order using a forex broker with direct market access, they can see all the offers available. Their clients can choose the best offer that they can get from the market. It means they execute trades directly from the liquidity makers or market participants. For example, if a forex trader wants to sell or buy an asset at a price, the forex brokers can buy or sell from the client at the offer the client is asking. They can also set the prices for an asset so that their clients buy or sell at the price they have offered. For scalpers, intraday and swing traders, we offer evaluation programs where you can prove your skills and get a funded account, where you can manage up to $600,000 to jump-start your trading career.

You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc. Forex brokers with STP systems transfer orders from traders to https://xcritical.com/ their liquidity providers who have access to the interbank market. STP brokers usually have several banks/financial institutions as liquidity providers, and each can have different bid/ask quotes. Forex trades, for example, have a larger leverage ratio than equity trading, and the determinants of currency price movement differ from those of equity markets.