Contents:

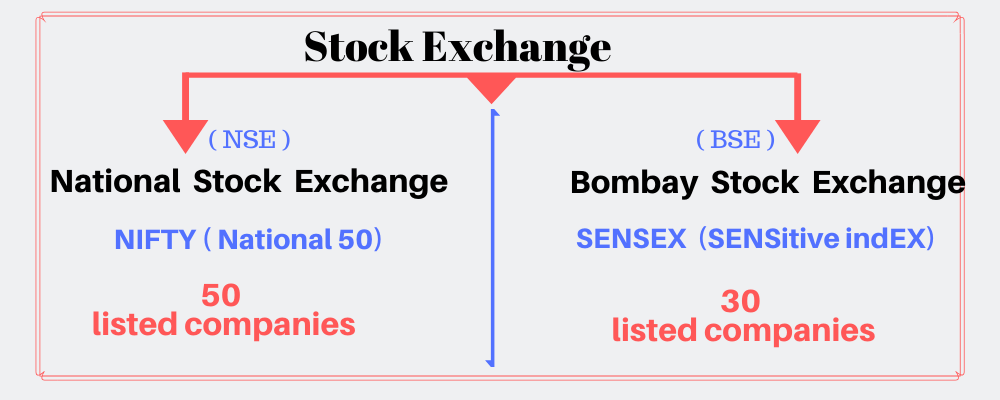

RSI indicator is taken into account overbought above 70 and oversold beneath 30. This chart features every day bars in grey with a 1-day SMA in pink to focus on closing costs . Working from left to right, the stock turned oversold in late July and found help round 44 . Bottoming is usually a process – this stock didn’t backside as soon because the oversold studying appeared. This is why merchants will typically affirm the Bollinger band indicators with value motion, or use the indicator along side different lagging tools or main indicators such as the RSI.

- It is crucial that you practise RSI trading strategies on demo account first, after which apply them to a stay account.

- Hello Traders, This indicator use the same concept as my previous indicator «CCI MTF Ob+Os».

- Many systems generate trading ideas by looking for divergences and failure swings.

A relative strength index can also be used, sometimes along with other technical indicators, to form strategies. Let us take a deeper on the same and how certain combinations with other technical analysis tools could help your RSI trading strategy. Traditionally, this value can be used to find overbought and oversold conditions. Here, a value above 80 is usually considered overbought.

RSI limitations

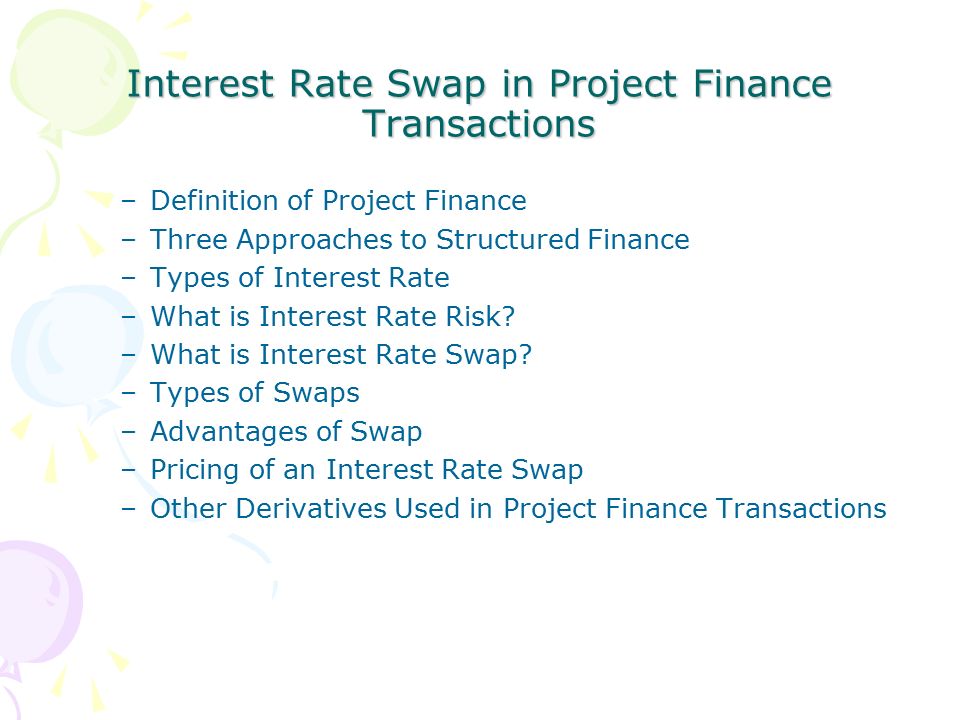

Like RSI,shifting common convergence divergence is a development-following momentum indicator that shows the connection between two moving averages of a security’s price. The MACD is calculated by subtracting the 26-periodexponential transferring average from the 12-interval EMA. The MACD indicator is special as a result of it brings collectively momentum and development in one indicator.

For example, if a oversold vs overbought is repeatedly reaching the overbought level of 70 you may want to adjust this level to 80. Here is the list of the top 10 stocks with RSI in overbought and oversold zones. The PCR or the Put Call Ratio indicator is a market sentiment indicator. Trend reversals can be spotted in Relative Strength Index and Money Flow Index using divergences like positive divergence or negative divergence. Also, failure swings are an important characteristic in momentum oscillators like RSI.

Failure of RSI Oversold

Get a best-https://1investing.in/ing eBook and online course by signing up for free. As the name suggests, any indicator gives an indication of the price, and they don’t dictate the price. Changes in the price will bring the movements in RSI levels and not vice versa. It showed an RSI hidden bearish divergence , and it proves that it was a fantastic opportunity to take a short trade as the price rallied in the south direction. Fundamentalists are more concerned about the company’s management, various products, Sales, Price to earnings ratio, ROE, Cash flow, Debt to equity ratio, Competition, etc.

It gives an indication of trend change & also the momentum within the trend. Time period generally considered is 20 days.CCI is relatively high when prices are far above their average & relatively low when prices are far below their average. The CCI typically oscillates above and below a zero line, above zero line it enters into positive territory & below zero into negative territory.

Since historical patterns are seen to repeat themselves, technical analysis uses prior levels to forecast future moves. The relative strength index helps identify overbought or oversold signals. A lot of times, stock price movements tend to bounce back where there are overbought or oversold conditions.

Get the Mini Trading Guide

It measures the total Put volume traded versus the total Call volume traded, known as Volume- PCR. If the index continues its slide, Nifty50 will find support near its 20-day moving average of 8,043. Traders should remain cautious as we come face to face with two major global events, US Fed rate-setting meeting and the Brexit vote.

12 oversold stocks to add to your watchlist. Is it finally time to get in? Mint – Mint

12 oversold stocks to add to your watchlist. Is it finally time to get in? Mint.

Posted: Wed, 01 Mar 2023 06:28:54 GMT [source]

The relative energy index is a technical indicator used in the analysis of financial markets. It is intended to chart the current and historical energy or weak point of a inventory or market based mostly on the closing costs of a latest trading period. The dynamic momentum index is utilized in technical analysis to find out if a security is overbought or oversold.

Because markets can appear to be irrational at occasions, a greater technique is to purchase when the oversold or overbought condition reverses, signaling the development has run its course. The Relative Strength Index , developed by J. Welles Wilder, is a momentum oscillator that measures the speed and change of price movements. Traditionally the RSI is considered overbought when above 70 and oversold when below 30. Signals can be generated by looking for divergences and failure swings.

What is the term OVERBOUGHT VS OVERSOLD says ?

In graphs , so on X axis if you see 40 , then read it as 4000 for nifty . Book your partial profits and be cautious with further buying for long term. I would not be surprised to see markets rise by over 10-15% more over next 1-2 months till the Budget but sooner or later I expect. Pay 20% or «var + elm» whichever is higher as upfront margin of the transaction value to trade in cash market segment. If you are still confused, then worry not – you can always check out our other podcasts, or simply visit to learn more about the markets. Friends, it is now time to look at some of the subtleties involved in interpreting with the RSI indicator.

- Traditionally the RSI is taken into account overbought when above 70 and oversold when below 30.

- It is not possible to compare MACD values for a group of securities with varying costs.

- You must wait for a candle to close beyond both lines of the MA’s.

You also have to decide how much money of your portfolio would you like to put in stock market after considering your risk-appetite. Its not a very good situation to madly buy for long term. Its a time when euphoria is at high point and it can take markets a little further. So you can jump in now with short term perspective, not long term !! To do that, we draw two horizontal lines at 30 and 70. When RSI increases beyond 70, the underlying security is considered to be overbought.

RSI: Stocks in overbought and oversold zones

Very high MFI that begins to fall below a reading of 80 while the underlying security continues to climb is a reversal signal to the downside. Conversely, a very low MFI reading that climbs above a reading of 20 while the underlying security continues to sell off is a reversal signal to the upside. Approximately 90% of price action occurs between the two bands. Any breakout above or below the bands is a major event. A moving average is a technical evaluation indicator that helps smooth out worth motion by filtering out the “noise” from random value fluctuations. The MACD measures the connection between two EMAs, whereas the RSI measures price change in relation to latest worth highs and lows.

I liked the approach to take long/short position using PE Ratio analysis. This is the BEST discovery in stock investing that I have come across in the recent past. We offer you a fixed rate and high income with most convenient plan terms for you. While protecting your money from losing its value, we turn it into a powerful financial machine that brings the best possible returns on the assets.

For beginners, indicators help avoid unnecessary trades, and for algo traders, they help develop a system. If you look at image-8, RSI bullish divergence failed many times in a downtrend. Crossovers can last a few days or a few weeks, relying on the strength of the transfer. The MACD line is the 12-day Exponential Moving Average much less the 26-day EMA.

So in a way, RS can be looked at as a benchmarking tool, which can be used to pick stocks. Any person who wants to learn technical analysis will be introduced to two indicators at the beginning – Moving Average and Relative Strength Index . After few hours of strong up move, RSI enters the overbought area followed by a bearish divergence.